Settings

Gain Loss Account – Default account

Default Payable Account – Default account

Payable Discount Account – Default account

Cheque Template – The template to be used for generating a cheque to be printed via the Payables section, 3 options

Default Receivable Account – Default account

Receivable Discount Account – Default account

Default Sales Account – Default account

Default Sales Tax Account – Default account

Default Supply Tax Account – Default account

Default Inventory Asset Account – Default account

Default COGS Expense Account – Default account

Default A/R Interest Account – Default account

Global Interest Rate – The rate used when manual interest is processed

Global Interest Period – The number of days before they system can apply interest when manually started

Global Interest Term – The term used on the interest transaction

Auto Post Transactions – Will auto post transactions if they are balanced

Federal Tax for Supply Events – Always apply federal tax on supply events

Bank Reconciliation Fuzzy Days – in bank reconciliation, when matching entries this is the number of days in the past and future that the system will match on

Credit Always Limited – when checked, if no credit is set on a customer then it is assumed that they have no credit, when not checked it is assumed that they have no limit.

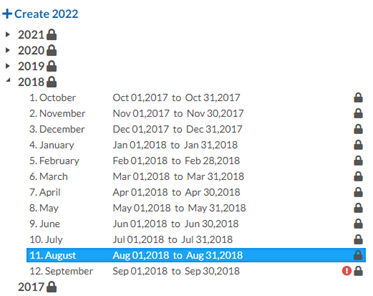

Fiscal Periods

This is where you can lock, unlock, and create Fiscal years and periods, clicking on the lock will toggle it.

Creating a new year will create 12 new periods as well, starting with the day after the last day of the last period with the rest according to the months

Uploads

Select a Template to use for example “GL Account” then drag and drop the file in the “Upload” box. The raw data from the spreadsheet will appear in the “Raw Data” section and the converted data will appear in the “Formatted Data” check over that data for errors and click “Insert Formatted Data” if it checks out.

Events

Allows you to set up the transactions that will be used for each event, what GL accounts, and the calculations.

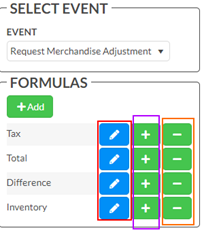

Select Event

A dropdown with the events available in the app, will load the currently setup transaction and any formulas associated with it.

Formulas

Allows the creating and editing of formulas as well as the ability to use the formula in the transaction, circled in red will open the edit window, circled in purple will add the formula as a debit entry, in orange as a credit entry. The add button will open a blank edit formula window.

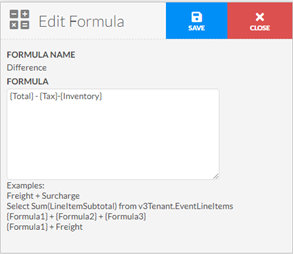

Edit Formula

Formula

- SQL select statement that returns one value must reference the proper table names and schema, or…

- A calculation using a combination of formula names, enclosed in braces ‘{‘, ‘}’, or event field names

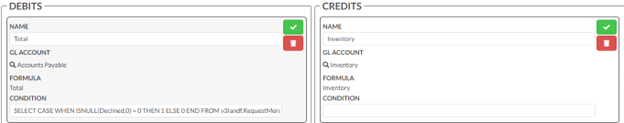

Edit Transaction

Name – the name of the entry, can be used to describe what is being combined

GL Account – The account that is used for the entry, selected via double-clicking on grid row, opened with the magnifier icon

Formula – Not editable in this section, to change the formula add and remove the entry

Condition – An SQL statement that returns one value that will be cast to BIT, used to determine whether to use this entry in the transaction

Default Transactions

Work Order

Formula

Costs

SELECT SUM(ROUND(ISNULL(UnitCost,0) * ISNULL(Quantity,0) ,2) ) FROM [SCHEMA].WorkOrdersLineItems

Transaction

- Type – Debit, Formula – Costs, GL – COGS

- Type – Credit, Formula – Costs, GL – Inventory

Receipt

Formula

Freight

SELECT ISNULL(Freight,0) from [SCHEMA].Receipts

InvSubtotal

SELECT SUM(CASE WHEN ISNULL(Inventory,0) = 1 then ISNULL(LineItemDiscountedSubtotal,0) ELSE 0 END) from [SCHEMA].ReceiptsLineItems

Subtotal

{freight} + {invsubtotal}

Tax

SELECT TotalTax from [SCHEMA].Receipts

Total

{Tax} + ISNULL(Subtotal,0) + ISNULL(Freight,0)

NonInvSubtotal

SELECT SUM(CASE WHEN ISNULL(Inventory,0) = 1 then ISNULL(LineItemDiscountedSubtotal,0) ELSE 0 END) from [SCHEMA].ReceiptsLineItems

Transaction

- Type – Debit, Formula – Subtotal, GL – Inventory

- Type – Debit, Formula – Tax, GL – Tax on Purchases

- Type – Debit, Formula – NonInvSubtotal, GL – COGS

- Type – Credit, Formula – Total, GL – A/P

Request Merchandise Adjustment

Formula

Tax

SELECT TotalTax from [SCHEMA].RequestMerchandiseAdjustments

Total

SELECT Total from [SCHEMA].RequestMerchandiseAdjustments

Difference

{Total} - {Tax}-{Inventory}

Inventory

SELECT SUM(ISNULL(UnitCost,0) * ISNULL(Quantity,0)) FROM [SCHEMA].RequestMerchandiseAdjustmentsLineItems

Transaction

- Type – Debit, Formula – Total, GL – A/P

SELECT CASE WHEN ISNULL(Declined,0) = 0 THEN 1 ELSE 0 END FROM [SCHEMA].RequestMerchandiseAdjustments

- Type – Debit, Formula – Total, GL – Waste

SELECT CASE WHEN ISNULL(Declined,0) = 0 THEN 0 ELSE 1 END FROM [SCHEMA].RequestMerchandiseAdjustments

- Type – Credit, Formula – Inventory, GL – Inventory

- Type – Credit, Formula – Difference, GL – Waste

- Type – Credit, Formula – Tax, GL – Tax on Purchases

Inventory Adjustment

Formula

Costs

SELECT SUM(ISNULL(UnitCost,0) * ISNULL(Quantity,0) ) FROM [SCHEMA].InventoryAdjustmentsLineItems

Transaction

- Type – Debit, Formula – Costs, GL – Inventory

- Type – Credit, Formula – Costs, GL – Waste